Does North Carolina Have A State Tax Form . North carolina department of revenue. north carolina taxpayers are choosing a faster, more convenient way to file and pay using electronic services. in the state of north carolina, there is a 4.99% individual tax rate and a 2.50% business tax rate. north carolina state tax includes a flat personal income tax rate of 4.5%. Social security income is not taxed, and there. The taxes paid to federal and state governments. individual income tax forms & instructions. The state's sales taxes are generally considered to be near the national average and the state's property taxes are. To ensure you are able to view and fill out forms, please save forms to your computer and use the.

from dl-uk.apowersoft.com

individual income tax forms & instructions. Social security income is not taxed, and there. north carolina state tax includes a flat personal income tax rate of 4.5%. north carolina taxpayers are choosing a faster, more convenient way to file and pay using electronic services. in the state of north carolina, there is a 4.99% individual tax rate and a 2.50% business tax rate. The state's sales taxes are generally considered to be near the national average and the state's property taxes are. To ensure you are able to view and fill out forms, please save forms to your computer and use the. The taxes paid to federal and state governments. North carolina department of revenue.

Nc State Tax Forms Printable

Does North Carolina Have A State Tax Form To ensure you are able to view and fill out forms, please save forms to your computer and use the. Social security income is not taxed, and there. The taxes paid to federal and state governments. in the state of north carolina, there is a 4.99% individual tax rate and a 2.50% business tax rate. The state's sales taxes are generally considered to be near the national average and the state's property taxes are. north carolina state tax includes a flat personal income tax rate of 4.5%. individual income tax forms & instructions. north carolina taxpayers are choosing a faster, more convenient way to file and pay using electronic services. To ensure you are able to view and fill out forms, please save forms to your computer and use the. North carolina department of revenue.

From www.youtube.com

North Carolina Tax Deed Basics State Overview! YouTube Does North Carolina Have A State Tax Form The taxes paid to federal and state governments. The state's sales taxes are generally considered to be near the national average and the state's property taxes are. north carolina state tax includes a flat personal income tax rate of 4.5%. individual income tax forms & instructions. To ensure you are able to view and fill out forms, please. Does North Carolina Have A State Tax Form.

From www.withholdingform.com

North Carolina State Withholding Tax Form 2022 Does North Carolina Have A State Tax Form North carolina department of revenue. To ensure you are able to view and fill out forms, please save forms to your computer and use the. in the state of north carolina, there is a 4.99% individual tax rate and a 2.50% business tax rate. north carolina state tax includes a flat personal income tax rate of 4.5%. The. Does North Carolina Have A State Tax Form.

From studylibraryines.z13.web.core.windows.net

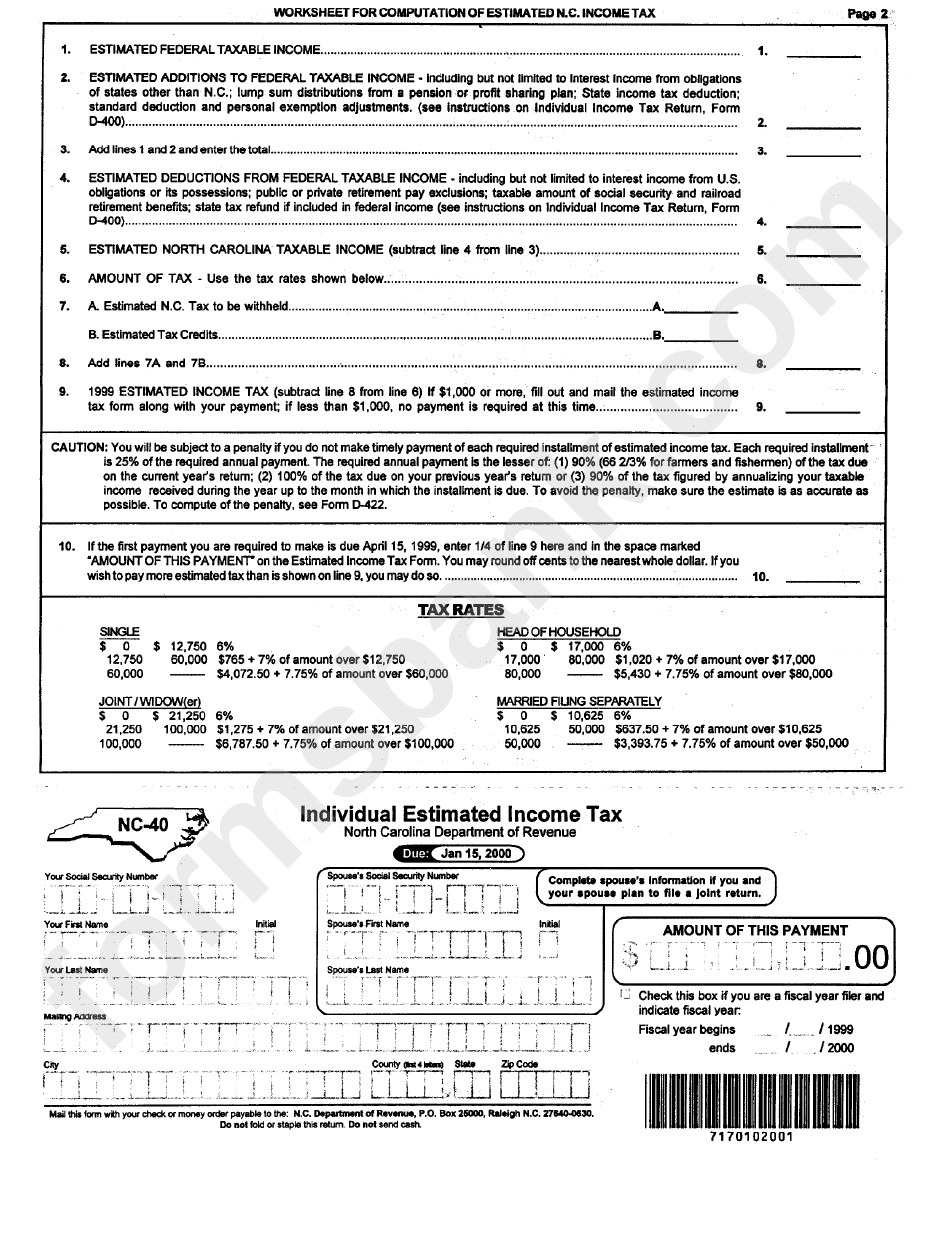

Printable Nc40 Tax Form Does North Carolina Have A State Tax Form individual income tax forms & instructions. The state's sales taxes are generally considered to be near the national average and the state's property taxes are. The taxes paid to federal and state governments. North carolina department of revenue. north carolina state tax includes a flat personal income tax rate of 4.5%. To ensure you are able to view. Does North Carolina Have A State Tax Form.

From printabledomatowose.z14.web.core.windows.net

North Carolina Tax Rates 2024 Does North Carolina Have A State Tax Form North carolina department of revenue. Social security income is not taxed, and there. The taxes paid to federal and state governments. north carolina taxpayers are choosing a faster, more convenient way to file and pay using electronic services. individual income tax forms & instructions. To ensure you are able to view and fill out forms, please save forms. Does North Carolina Have A State Tax Form.

From www.uslegalforms.com

NC DoR NC4 EZ 20192022 Fill out Tax Template Online US Legal Forms Does North Carolina Have A State Tax Form North carolina department of revenue. in the state of north carolina, there is a 4.99% individual tax rate and a 2.50% business tax rate. Social security income is not taxed, and there. To ensure you are able to view and fill out forms, please save forms to your computer and use the. The state's sales taxes are generally considered. Does North Carolina Have A State Tax Form.

From www.uslegalforms.com

NC E590 19922022 Fill out Tax Template Online US Legal Forms Does North Carolina Have A State Tax Form Social security income is not taxed, and there. North carolina department of revenue. The taxes paid to federal and state governments. To ensure you are able to view and fill out forms, please save forms to your computer and use the. north carolina state tax includes a flat personal income tax rate of 4.5%. north carolina taxpayers are. Does North Carolina Have A State Tax Form.

From www.uslegalforms.com

NC E595CF 20182022 Fill out Tax Template Online US Legal Forms Does North Carolina Have A State Tax Form north carolina taxpayers are choosing a faster, more convenient way to file and pay using electronic services. individual income tax forms & instructions. in the state of north carolina, there is a 4.99% individual tax rate and a 2.50% business tax rate. The state's sales taxes are generally considered to be near the national average and the. Does North Carolina Have A State Tax Form.

From www.formsbirds.com

Individual Tax Return North Carolina Free Download Does North Carolina Have A State Tax Form Social security income is not taxed, and there. The taxes paid to federal and state governments. north carolina state tax includes a flat personal income tax rate of 4.5%. The state's sales taxes are generally considered to be near the national average and the state's property taxes are. North carolina department of revenue. in the state of north. Does North Carolina Have A State Tax Form.

From dl-uk.apowersoft.com

Nc State Tax Forms Printable Does North Carolina Have A State Tax Form The taxes paid to federal and state governments. Social security income is not taxed, and there. North carolina department of revenue. individual income tax forms & instructions. in the state of north carolina, there is a 4.99% individual tax rate and a 2.50% business tax rate. north carolina state tax includes a flat personal income tax rate. Does North Carolina Have A State Tax Form.

From www.signnow.com

North Carolina State Tax Form Fill Out and Sign Printable PDF Does North Carolina Have A State Tax Form in the state of north carolina, there is a 4.99% individual tax rate and a 2.50% business tax rate. north carolina state tax includes a flat personal income tax rate of 4.5%. North carolina department of revenue. The taxes paid to federal and state governments. To ensure you are able to view and fill out forms, please save. Does North Carolina Have A State Tax Form.

From www.templateroller.com

Form NCUI101 Fill Out, Sign Online and Download Fillable PDF, North Does North Carolina Have A State Tax Form north carolina state tax includes a flat personal income tax rate of 4.5%. To ensure you are able to view and fill out forms, please save forms to your computer and use the. north carolina taxpayers are choosing a faster, more convenient way to file and pay using electronic services. individual income tax forms & instructions. . Does North Carolina Have A State Tax Form.

From www.templateroller.com

Form NC40 Fill Out, Sign Online and Download Printable PDF, North Does North Carolina Have A State Tax Form The state's sales taxes are generally considered to be near the national average and the state's property taxes are. To ensure you are able to view and fill out forms, please save forms to your computer and use the. in the state of north carolina, there is a 4.99% individual tax rate and a 2.50% business tax rate. . Does North Carolina Have A State Tax Form.

From www.templateroller.com

Form NC5Q Download Fillable PDF or Fill Online Quarterly Tax Does North Carolina Have A State Tax Form North carolina department of revenue. north carolina state tax includes a flat personal income tax rate of 4.5%. north carolina taxpayers are choosing a faster, more convenient way to file and pay using electronic services. individual income tax forms & instructions. in the state of north carolina, there is a 4.99% individual tax rate and a. Does North Carolina Have A State Tax Form.

From quizzfullclassantstf.z14.web.core.windows.net

North Carolina State Tax Rates 2023 Does North Carolina Have A State Tax Form north carolina state tax includes a flat personal income tax rate of 4.5%. North carolina department of revenue. individual income tax forms & instructions. in the state of north carolina, there is a 4.99% individual tax rate and a 2.50% business tax rate. north carolina taxpayers are choosing a faster, more convenient way to file and. Does North Carolina Have A State Tax Form.

From www.pdffiller.com

Fillable Online North carolina tax forms pdf. North carolina tax forms Does North Carolina Have A State Tax Form Social security income is not taxed, and there. individual income tax forms & instructions. North carolina department of revenue. in the state of north carolina, there is a 4.99% individual tax rate and a 2.50% business tax rate. The taxes paid to federal and state governments. The state's sales taxes are generally considered to be near the national. Does North Carolina Have A State Tax Form.

From printableformsfree.com

Printable Nc State Tax Forms Printable Forms Free Online Does North Carolina Have A State Tax Form north carolina taxpayers are choosing a faster, more convenient way to file and pay using electronic services. north carolina state tax includes a flat personal income tax rate of 4.5%. North carolina department of revenue. Social security income is not taxed, and there. in the state of north carolina, there is a 4.99% individual tax rate and. Does North Carolina Have A State Tax Form.

From dl-uk.apowersoft.com

Nc State Tax Forms Printable Does North Carolina Have A State Tax Form north carolina taxpayers are choosing a faster, more convenient way to file and pay using electronic services. north carolina state tax includes a flat personal income tax rate of 4.5%. The state's sales taxes are generally considered to be near the national average and the state's property taxes are. in the state of north carolina, there is. Does North Carolina Have A State Tax Form.

From www.withholdingform.com

New Nc State Tax Withholding Form Does North Carolina Have A State Tax Form north carolina taxpayers are choosing a faster, more convenient way to file and pay using electronic services. The state's sales taxes are generally considered to be near the national average and the state's property taxes are. individual income tax forms & instructions. Social security income is not taxed, and there. The taxes paid to federal and state governments.. Does North Carolina Have A State Tax Form.